What Is The Forex Market

The strange exchange marketplace (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) marketplace for the trading of currencies. This market determines foreign substitution rates for every currency. It includes all aspects of ownership, selling and exchanging currencies at current or determined prices. In terms of trading book, it is past far the largest market in the earth, followed by the credit marketplace.[1]

The main participants in this market are the larger international banks. Financial centers around the world function equally anchors of trading betwixt a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are e'er traded in pairs, the foreign exchange market does not set a currency's absolute value merely rather determines its relative value by setting the market price of 1 currency if paid for with another. Ex: US$1 is worth X CAD, or CHF, or JPY, etc.

The foreign commutation marketplace works through financial institutions and operates on several levels. Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in big quantities of foreign exchange trading. Almost foreign exchange dealers are banks, then this backside-the-scenes market is sometimes chosen the "interbank marketplace" (although a few insurance companies and other kinds of financial firms are involved). Trades between foreign commutation dealers can exist very large, involving hundreds of millions of dollars. Because of the sovereignty issue when involving two currencies, Forex has little (if whatsoever) supervisory entity regulating its actions.

The foreign exchange market assists international trade and investments by enabling currency conversion. For example, information technology permits a business in the United States to import appurtenances from European Union member states, especially Eurozone members, and pay Euros, even though its income is in Us dollars. It also supports direct speculation and evaluation relative to the value of currencies and the deport trade speculation, based on the differential interest charge per unit between ii currencies.[2]

In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying with some quantity of another currency.

The modern strange exchange market began forming during the 1970s. This followed iii decades of government restrictions on foreign exchange transactions nether the Bretton Woods arrangement of monetary management, which prepare out the rules for commercial and financial relations amidst the world's major industrial states after Earth War 2. Countries gradually switched to floating exchange rates from the previous exchange rate regime, which remained stock-still per the Bretton Wood system.

The foreign exchange market is unique because of the following characteristics:

- its huge trading volume, representing the largest asset class in the world leading to loftier liquidity;

- its geographical dispersion;

- its continuous performance: 24 hours a twenty-four hours except for weekends, i.east., trading from 22:00 GMT on Sunday (Sydney) until 22:00 GMT Friday (New York);

- the variety of factors that affect commutation rates;

- the depression margins of relative turn a profit compared with other markets of fixed income; and

- the employ of leverage to heighten turn a profit and loss margins and with respect to account size.

As such, it has been referred to as the market closest to the ideal of perfect competition, notwithstanding currency intervention by central banks.

According to the Bank for International Settlements, the preliminary global results from the 2019 Triennial Central Bank Survey of Foreign Substitution and OTC Derivatives Markets Activity show that trading in foreign exchange markets averaged $half-dozen.6 trillion per day in April 2019. This is upwards from $5.ane trillion in April 2016. Measured past value, foreign substitution swaps were traded more than whatsoever other instrument in April 2019, at $3.2 trillion per day, followed by spot trading at $2 trillion.[three]

The $6.six trillion pause-down is as follows:

- $2 trillion in spot transactions

- $1 trillion in outright forwards

- $iii.two trillion in foreign substitution swaps

- $108 billion currency swaps

- $294 billion in options and other products

History

Ancient

Currency trading and exchange first occurred in ancient times.[iv] Coin-changers (people helping others to change money and also taking a committee or charging a fee) were living in the Holy State in the times of the Talmudic writings (Biblical times). These people (sometimes called "kollybistẻs") used city stalls, and at banquet times the Temple's Court of the Gentiles instead.[5] Money-changers were besides the silversmiths and/or goldsmiths[vi] of more recent ancient times.

During the 4th century AD, the Byzantine authorities kept a monopoly on the substitution of currency.[seven]

Papyri PCZ I 59021 (c.259/eight BC), shows the occurrences of commutation of coinage in Ancient Arab republic of egypt.[8]

Currency and exchange were important elements of trade in the aboriginal globe, enabling people to buy and sell items like food, pottery, and raw materials.[nine] If a Greek coin held more golden than an Egyptian coin due to its size or content, then a merchant could barter fewer Greek gold coins for more than Egyptian ones, or for more cloth appurtenances. This is why, at some point in their history, most world currencies in apportionment today had a value stock-still to a specific quantity of a recognized standard like silver and gold.

Medieval and later

During the 15th century, the Medici family unit were required to open banks at strange locations in order to substitution currencies to act on behalf of textile merchants.[10] [xi] To facilitate trade, the bank created the nostro (from Italian, this translates to "ours") business relationship book which contained two columned entries showing amounts of strange and local currencies; data pertaining to the keeping of an account with a foreign bank.[12] [xiii] [fourteen] [fifteen] During the 17th (or 18th) century, Amsterdam maintained an agile Forex market place.[16] In 1704, strange substitution took place between agents acting in the interests of the Kingdom of England and the County of The netherlands.[17]

Early on modern

Alex. Brown & Sons traded foreign currencies around 1850 and was a leading currency trader in the USA.[xviii] In 1880, J.G. do Espírito Santo de Silva (Banco Espírito Santo) practical for and was given permission to appoint in a foreign substitution trading business.[19] [20]

The year 1880 is considered by at least 1 source to be the showtime of modern strange exchange: the golden standard began in that year.[21]

Prior to the First World State of war, there was a much more limited control of international merchandise. Motivated past the onset of war, countries abased the gilded standard monetary system.[22]

Modern to mail service-modernistic

From 1899 to 1913, holdings of countries' foreign exchange increased at an annual rate of 10.8%, while holdings of gold increased at an annual rate of vi.3% betwixt 1903 and 1913.[23]

At the cease of 1913, virtually half of the world's foreign exchange was conducted using the pound sterling.[24] The number of foreign banks operating within the boundaries of London increased from iii in 1860, to 71 in 1913. In 1902, in that location were just two London foreign exchange brokers.[25] At the start of the 20th century, trades in currencies was most active in Paris, New York City and Berlin; United kingdom remained largely uninvolved until 1914. Between 1919 and 1922, the number of foreign substitution brokers in London increased to 17; and in 1924, there were 40 firms operating for the purposes of substitution.[26]

During the 1920s, the Kleinwort family unit were known as the leaders of the foreign exchange market, while Japheth, Montagu & Co. and Seligman however warrant recognition as pregnant FX traders.[27] The trade in London began to resemble its modern manifestation. By 1928, Forex trade was integral to the financial functioning of the city. Continental exchange controls, plus other factors in Europe and Latin America, hampered any attempt at wholesale prosperity from merchandise[ clarification needed ] for those of 1930s London.[28]

After World State of war Two

In 1944, the Bretton Woods Accord was signed, assuasive currencies to fluctuate within a range of ±1% from the currency's par exchange rate.[29] In Japan, the Foreign Substitution Banking concern Police force was introduced in 1954. As a event, the Banking company of Tokyo became a center of foreign commutation by September 1954. Between 1954 and 1959, Japanese law was changed to allow foreign substitution dealings in many more Western currencies.[30]

U.Southward. President, Richard Nixon is credited with ending the Bretton Woods Accordance and stock-still rates of exchange, eventually resulting in a free-floating currency system. After the Accord ended in 1971,[31] the Smithsonian Agreement allowed rates to fluctuate by upwards to ±2%. In 1961–62, the volume of foreign operations by the U.South. Federal Reserve was relatively low.[32] [33] Those involved in controlling exchange rates found the boundaries of the Agreement were not realistic and and then ceased this[ description needed ] in March 1973, when sometime afterwards[ clarification needed ] none of the major currencies were maintained with a capacity for conversion to aureate,[ clarification needed ] organizations relied instead on reserves of currency.[34] [35] From 1970 to 1973, the book of trading in the market increased 3-fold.[36] [37] [38] At some time (according to Gandolfo during Feb–March 1973) some of the markets were "split up", and a 2-tier currency market place[ clarification needed ] was subsequently introduced, with dual currency rates. This was abolished in March 1974.[39] [40] [41]

Reuters introduced computer monitors during June 1973, replacing the telephones and telex used previously for trading quotes.[42]

Markets shut

Due to the ultimate ineffectiveness of the Bretton Woods Accord and the European Joint Float, the forex markets were forced to close[ clarification needed ] sometime during 1972 and March 1973.[43] The largest purchase of US dollars in the history of 1976[ description needed ] was when the Due west German government achieved an almost 3 billion dollar acquisition (a effigy is given equally ii.75 billion in full by The Statesman: Volume 18 1974). This consequence indicated the impossibility of balancing of commutation rates by the measures of command used at the time, and the budgetary organisation and the foreign exchange markets in West Germany and other countries within Europe airtight for ii weeks (during February and, or, March 1973. Giersch, Paqué, & Schmieding state closed subsequently purchase of "7.5 million Dmarks" Brawley states "... Exchange markets had to be airtight. When they re-opened ... March ane " that is a large buy occurred after the close).[44] [45] [46] [47]

Later on 1973

In adult nations, state control of foreign substitution trading ended in 1973 when complete floating and relatively free marketplace conditions of modernistic times began.[48] Other sources claim that the get-go time a currency pair was traded by U.Due south. retail customers was during 1982, with boosted currency pairs becoming bachelor past the next yr.[49] [fifty]

On 1 January 1981, as part of changes get-go during 1978, the People's Bank of Red china allowed certain domestic "enterprises" to participate in foreign exchange trading.[51] [52] Old during 1981, the Due south Korean government ended Forex controls and allowed free trade to occur for the first time. During 1988, the land'due south government accepted the IMF quota for international merchandise.[53]

Intervention past European banks (especially the Bundesbank) influenced the Forex market place on 27 February 1985.[54] The greatest proportion of all trades worldwide during 1987 were within the United Kingdom (slightly over one quarter). The United States had the second highest interest in trading.[55]

During 1991, Iran changed international agreements with some countries from oil-barter to strange exchange.[56]

Market size and liquidity

Main foreign exchange market turnover, 1988–2007, measured in billions of USD.

The foreign exchange market is the most liquid financial market in the world. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators, other commercial corporations, and individuals. According to the 2019 Triennial Key Banking concern Survey, coordinated past the Banking concern for International Settlements, boilerplate daily turnover was $vi.half-dozen trillion in April 2019 (compared to $1.nine trillion in 2004).[3] Of this $6.6 trillion, $2 trillion was spot transactions and $iv.six trillion was traded in outright frontward, swaps, and other derivatives.

Foreign substitution is traded in an over-the-counter market where brokers/dealers negotiate straight with 1 another, and then there is no fundamental exchange or clearing house. The biggest geographic trading center is the United Kingdom, primarily London. In Apr 2019, trading in the Uk accounted for 43.i% of the total, making information technology by far the most important center for foreign exchange trading in the world. Owing to London'southward say-so in the marketplace, a detail currency'due south quoted toll is usually the London market price. For example, when the Imf calculates the value of its special drawing rights every day, they use the London market prices at noon that 24-hour interval. Trading in the U.s.a. accounted for sixteen.5%, Singapore and Hong Kong business relationship for 7.half-dozen% and Japan accounted for 4.5%.[3]

Turnover of exchange-traded foreign substitution futures and options was growing rapidly in 2004-2013, reaching $145 billion in Apr 2013 (double the turnover recorded in April 2007).[57] As of Apr 2019, exchange-traded currency derivatives represent 2% of OTC foreign exchange turnover. Foreign exchange futures contracts were introduced in 1972 at the Chicago Mercantile Substitution and are traded more than to most other futures contracts.

Most developed countries allow the trading of derivative products (such equally futures and options on futures) on their exchanges. All these developed countries already have fully convertible capital accounts. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. The utilize of derivatives is growing in many emerging economies.[58] Countries such equally S Korea, S Africa, and Republic of india accept established currency futures exchanges, despite having some capital letter controls.

Foreign exchange trading increased by xx% betwixt April 2007 and April 2010 and has more than doubled since 2004.[59] The increase in turnover is due to a number of factors: the growing importance of foreign substitution every bit an asset grade, the increased trading activity of high-frequency traders, and the emergence of retail investors as an important market segment. The growth of electronic execution and the various option of execution venues has lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. Past 2010, retail trading was estimated to account for upward to 10% of spot turnover, or $150 billion per day (run across below: Retail foreign exchange traders).

Market participants

| Rank | Proper name | Market share |

|---|---|---|

| ane | | 10.78 % |

| 2 | | 8.thirteen % |

| 3 | | 7.58 % |

| 4 | | 7.38 % |

| 5 | | 5.50 % |

| vi | | v.33 % |

| seven | | 5.23 % |

| 8 | | four.62 % |

| ix | | 4.61 % |

| x | | four.50 % |

Unlike a stock market, the strange exchange market is divided into levels of access. At the tiptop is the interbank foreign commutation market, which is made up of the largest commercial banks and securities dealers. Inside the interbank market, spreads, which are the divergence between the bid and ask prices, are razor sharp and not known to players outside the inner circle. The difference between the bid and ask prices widens (for instance from 0 to 1 pip to 1–ii pips for currencies such as the EUR) as yous get down the levels of admission. This is due to volume. If a trader tin guarantee big numbers of transactions for big amounts, they can need a smaller departure between the bid and ask toll, which is referred to as a meliorate spread. The levels of access that make up the foreign substitution market place are determined past the size of the "line" (the amount of money with which they are trading). The summit-tier interbank marketplace accounts for 51% of all transactions.[61] From there, smaller banks, followed by big multi-national corporations (which need to hedge risk and pay employees in different countries), big hedge funds, and even some of the retail market makers. According to Galati and Melvin, "Pension funds, insurance companies, mutual funds, and other institutional investors accept played an increasingly important function in financial markets in general, and in FX markets in detail, since the early 2000s." (2004) In improver, he notes, "Hedge funds take grown markedly over the 2001–2004 period in terms of both number and overall size".[62] Primal banks also participate in the strange exchange market to marshal currencies to their economic needs.

Commercial companies

An important part of the foreign commutation marketplace comes from the financial activities of companies seeking foreign commutation to pay for appurtenances or services. Commercial companies often trade adequately modest amounts compared to those of banks or speculators, and their trades oft have a piffling short-term impact on market rates. Nevertheless, trade flows are an important factor in the long-term management of a currency'southward commutation charge per unit. Some multinational corporations (MNCs) can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other marketplace participants.

Central banks

National central banks play an of import role in the foreign exchange markets. They try to control the coin supply, inflation, and/or interest rates and often have official or unofficial target rates for their currencies. They can utilize their ofttimes substantial foreign exchange reserves to stabilize the marketplace. Nonetheless, the effectiveness of central bank "stabilizing speculation" is hundred-to-one because cardinal banks do non go bankrupt if they make big losses as other traders would. In that location is also no disarming prove that they actually brand a profit from trading.

Foreign exchange fixing

Foreign substitution fixing is the daily monetary exchange rate fixed by the national banking company of each country. The idea is that fundamental banks utilize the fixing time and exchange rate to evaluate the behavior of their currency. Fixing exchange rates reflect the real value of equilibrium in the market. Banks, dealers, and traders employ fixing rates as a market trend indicator.

The mere expectation or rumor of a cardinal bank foreign exchange intervention might exist enough to stabilize the currency. However, aggressive intervention might be used several times each year in countries with a dirty float currency authorities. Central banks do non always accomplish their objectives. The combined resources of the market can hands overwhelm any central bank.[63] Several scenarios of this nature were seen in the 1992–93 European Exchange Rate Mechanism plummet, and in more than recent times in Asia.

Investment management firms

Investment management firms (who typically manage big accounts on behalf of customers such as pension funds and endowments) apply the strange commutation marketplace to facilitate transactions in strange securities. For case, an investment director bearing an international disinterestedness portfolio needs to buy and sell several pairs of strange currencies to pay for strange securities purchases.

Some investment management firms as well accept more speculative specialist currency overlay operations, which manage clients' currency exposures with the aim of generating profits as well every bit limiting risk. While the number of this type of specialist firms is quite small, many have a large value of assets under direction and can, therefore, generate large trades.

Retail foreign exchange traders

Private retail speculative traders constitute a growing segment of this marketplace. Currently, they participate indirectly through brokers or banks. Retail brokers, while largely controlled and regulated in the US past the Commodity Futures Trading Commission and National Futures Association, accept previously been subjected to periodic foreign exchange fraud.[64] [65] To deal with the issue, in 2010 the NFA required its members that deal in the Forex markets to register as such (i.e., Forex CTA instead of a CTA). Those NFA members that would traditionally be subject to minimum net capital requirements, FCMs and IBs, are subject to greater minimum net capital requirements if they deal in Forex. A number of the foreign exchange brokers operate from the UK under Financial Services Authority regulations where foreign exchange trading using margin is part of the wider over-the-counter derivatives trading manufacture that includes contracts for difference and financial spread betting.

There are ii main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers. Brokers serve as an amanuensis of the customer in the broader FX market place, by seeking the best price in the marketplace for a retail order and dealing on behalf of the retail customer. They charge a committee or "mark-up" in addition to the price obtained in the market. Dealers or market makers, by contrast, typically human action as principals in the transaction versus the retail customer, and quote a price they are willing to deal at.

Non-banking concern strange exchange companies

Non-depository financial institution foreign exchange companies offer currency commutation and international payments to private individuals and companies. These are also known every bit "foreign exchange brokers" simply are distinct in that they exercise non offering speculative trading but rather currency exchange with payments (i.e., there is usually a physical delivery of currency to a depository financial institution account).

It is estimated that in the U.k., 14% of currency transfers/payments are made via Strange Exchange Companies.[66] These companies' selling point is usually that they volition offer ameliorate exchange rates or cheaper payments than the customer's bank.[67] These companies differ from Money Transfer/Remittance Companies in that they by and large offer college-value services. The volume of transactions done through Foreign Exchange Companies in India amounts to about United states$2 billion[68] per day This does not compete favorably with any well developed foreign exchange market place of international repute, but with the entry of online Foreign Exchange Companies the market is steadily growing. Around 25% of currency transfers/payments in India are made via not-bank Strange Exchange Companies.[69] Almost of these companies apply the USP of better exchange rates than the banks. They are regulated past FEDAI and any transaction in foreign Exchange is governed past the Foreign Commutation Management Act, 1999 (FEMA).

Money transfer/remittance companies and bureaux de alter

Money transfer companies/remittance companies perform loftier-volume low-value transfers more often than not by economic migrants back to their home state. In 2007, the Aite Group estimated that at that place were $369 billion of remittances (an increase of 8% on the previous year). The four largest foreign markets (India, China, Mexico, and the Philippines) receive $95 billion. The largest and best-known provider is Western Union with 345,000 agents globally, followed by UAE Exchange.[ citation needed ] Bureaux de change or currency transfer companies provide low-value foreign exchange services for travelers. These are typically located at airports and stations or at tourist locations and permit physical notes to be exchanged from one currency to another. They access strange exchange markets via banks or not-bank foreign substitution companies.

Trading characteristics

| Rank | Currency | ISO 4217 code | Symbol | Proportion of daily volume, April 2019 |

|---|---|---|---|---|

| 1 | | USD | US$ | 88.3% |

| 2 | | EUR | € | 32.3% |

| 3 | | JPY | 円 / ¥ | sixteen.8% |

| 4 | | GBP | £ | 12.8% |

| 5 | | AUD | A$ | half-dozen.viii% |

| 6 | | CAD | C$ | v.0% |

| 7 | | CHF | CHF | v.0% |

| viii | | CNY | 元 / ¥ | 4.iii% |

| ix | | HKD | HK$ | 3.5% |

| x | | NZD | NZ$ | 2.1% |

| eleven | | SEK | kr | 2.0% |

| 12 | | KRW | ₩ | two.0% |

| xiii | | SGD | Southward$ | 1.viii% |

| 14 | | NOK | kr | 1.8% |

| xv | | MXN | $ | i.7% |

| 16 | | INR | ₹ | i.vii% |

| 17 | | RUB | ₽ | ane.1% |

| 18 | | ZAR | R | ane.ane% |

| xix | | Endeavour | ₺ | 1.ane% |

| 20 | | BRL | R$ | 1.1% |

| 21 | | TWD | NT$ | 0.ix% |

| 22 | | DKK | kr | 0.6% |

| 23 | | PLN | zł | 0.6% |

| 24 | | THB | ฿ | 0.five% |

| 25 | | IDR | Rp | 0.4% |

| 26 | | HUF | Ft | 0.iv% |

| 27 | | CZK | Kč | 0.4% |

| 28 | | ILS | ₪ | 0.3% |

| 29 | | CLP | CLP$ | 0.3% |

| 30 | | PHP | ₱ | 0.3% |

| 31 | | AED | د.إ | 0.2% |

| 32 | | COP | COL$ | 0.2% |

| 33 | | SAR | ﷼ | 0.2% |

| 34 | | MYR | RM | 0.1% |

| 35 | | RON | L | 0.one% |

| … | | 2.2% | ||

| Full[note 1] | 200.0% | |||

At that place is no unified or centrally cleared market for the majority of trades, and there is very little cross-edge regulation. Due to the over-the-counter (OTC) nature of currency markets, at that place are rather a number of interconnected marketplaces, where unlike currencies instruments are traded. This implies that there is not a single commutation charge per unit only rather a number of different rates (prices), depending on what bank or market maker is trading, and where information technology is. In do, the rates are quite close due to arbitrage. Due to London'due south potency in the market, a particular currency's quoted price is usually the London market price. Major trading exchanges include Electronic Broking Services (EBS) and Thomson Reuters Dealing, while major banks as well offer trading systems. A joint venture of the Chicago Mercantile Substitution and Reuters, called Fxmarketspace opened in 2007 and aspired but failed to the role of a central market immigration mechanism.[ citation needed ]

The principal trading centers are London and New York City, though Tokyo, Hong Kong, and Singapore are all important centers every bit well. Banks throughout the globe participate. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session.

Fluctuations in exchange rates are ordinarily caused by actual monetary flows too every bit by expectations of changes in monetary flows. These are caused by changes in gdp (GDP) growth, inflation (purchasing power parity theory), interest rates (interest rate parity, Domestic Fisher issue, International Fisher event), budget and trade deficits or surpluses, large cross-border M&A deals and other macroeconomic conditions. Major news is released publicly, frequently on scheduled dates, so many people have access to the same news at the aforementioned time. However, big banks have an important advantage; they can see their customers' gild flow.

Currencies are traded confronting one another in pairs. Each currency pair thus constitutes an individual trading product and is traditionally noted XXXYYY or Thirty/YYY, where Xxx and YYY are the ISO 4217 international 3-letter code of the currencies involved. The offset currency (Thirty) is the base of operations currency that is quoted relative to the second currency (YYY), called the counter currency (or quote currency). For instance, the quotation EURUSD (EUR/USD) ane.5465 is the price of the Euro expressed in US dollars, meaning 1 euro = 1.5465 dollars. The market convention is to quote most exchange rates against the USD with the Usa dollar as the base currency (east.g. USDJPY, USDCAD, USDCHF). The exceptions are the British pound (GBP), Australian dollar (AUD), the New Zealand dollar (NZD) and the euro (EUR) where the USD is the counter currency (e.g. GBPUSD, AUDUSD, NZDUSD, EURUSD).

The factors affecting XXX volition touch both XXXYYY and XXXZZZ. This causes a positive currency correlation between XXXYYY and XXXZZZ.

On the spot market, according to the 2019 Triennial Survey, the near heavily traded bilateral currency pairs were:

- EURUSD: 24.0%

- USDJPY: thirteen.2%

- GBPUSD (besides called cablevision): ix.6%

The U.Due south. currency was involved in 88.3% of transactions, followed by the euro (32.3%), the yen (16.eight%), and sterling (12.8%) (see table). Volume percentages for all individual currencies should add up to 200%, as each transaction involves two currencies.

Trading in the euro has grown considerably since the currency's creation in January 1999, and how long the foreign exchange marketplace will remain dollar-centered is open up to debate. Until recently, trading the euro versus a non-European currency ZZZ would take usually involved two trades: EURUSD and USDZZZ. The exception to this is EURJPY, which is an established traded currency pair in the interbank spot marketplace.

Determinants of exchange rates

In a fixed commutation rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain (and predict) the fluctuations in exchange rates in a floating substitution rate authorities, including:

- International parity conditions: Relative purchasing power parity, interest rate parity, Domestic Fisher effect, International Fisher effect. To some extent the above theories provide logical explanation for the fluctuations in exchange rates, nevertheless these theories falter as they are based on challengeable assumptions (east.g., free flow of goods, services, and capital) which seldom hold true in the real world.

- Balance of payments model: This model, however, focuses largely on tradable goods and services, ignoring the increasing role of global upper-case letter flows. Information technology failed to provide any explanation for the continuous appreciation of the US dollar during the 1980s and nearly of the 1990s, despite the soaring US current business relationship deficit.

- Nugget market model: views currencies as an important nugget class for constructing investment portfolios. Nugget prices are influenced mostly by people's willingness to hold the existing quantities of assets, which in turn depends on their expectations on the time to come worth of these assets. The asset market model of substitution rate conclusion states that "the substitution rate between two currencies represents the toll that just balances the relative supplies of, and demand for, assets denominated in those currencies."

None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames. For shorter time frames (less than a few days), algorithms tin can be devised to predict prices. Information technology is understood from the above models that many macroeconomic factors affect the substitution rates and in the end currency prices are a result of dual forces of supply and demand. The earth's currency markets tin be viewed every bit a huge melting pot: in a large and ever-changing mix of electric current events, supply and demand factors are constantly shifting, and the price of i currency in relation to another shifts appropriately. No other marketplace encompasses (and distills) as much of what is going on in the world at any given time as foreign commutation.[71]

Supply and demand for any given currency, and thus its value, are not influenced past any single chemical element, simply rather by several. These elements generally fall into three categories: economic factors, political conditions and market psychology.

Economic factors

Economic factors include: (a) economic policy, disseminated by government agencies and key banks, (b) economic conditions, generally revealed through economic reports, and other economical indicators.

- Economical policy comprises regime financial policy (budget/spending practices) and budgetary policy (the ways past which a government's central bank influences the supply and "cost" of coin, which is reflected past the level of interest rates).

- Government upkeep deficits or surpluses: The market usually reacts negatively to widening regime budget deficits, and positively to narrowing upkeep deficits. The affect is reflected in the value of a land'southward currency.

- Residue of trade levels and trends: The trade flow between countries illustrates the need for appurtenances and services, which in turn indicates need for a state'southward currency to bear trade. Surpluses and deficits in trade of appurtenances and services reverberate the competitiveness of a nation'southward economy. For example, trade deficits may have a negative touch on a nation's currency.

- Inflation levels and trends: Typically a currency will lose value if there is a high level of inflation in the country or if inflation levels are perceived to be rising. This is because inflation erodes purchasing power, thus need, for that item currency. However, a currency may sometimes strengthen when inflation rises considering of expectations that the central bank will raise brusk-term interest rates to combat ascent aggrandizement.

- Economical growth and health: Reports such as Gross domestic product, employment levels, retail sales, chapters utilization and others, item the levels of a country'southward economical growth and wellness. By and large, the more healthy and robust a country's economy, the better its currency will perform, and the more demand for it there will be.

- Productivity of an economy: Increasing productivity in an economy should positively influence the value of its currency. Its effects are more prominent if the increase is in the traded sector.[72]

Political conditions

Internal, regional, and international political conditions and events tin have a profound upshot on currency markets.

All exchange rates are susceptible to political instability and anticipations near the new ruling political party. Political upheaval and instability can have a negative impact on a nation'south economy. For instance, destabilization of coalition governments in Pakistan and Thailand can negatively affect the value of their currencies. Similarly, in a state experiencing fiscal difficulties, the rise of a political faction that is perceived to be fiscally responsible can take the contrary upshot. Also, events in one country in a region may spur positive/negative interest in a neighboring country and, in the process, touch on its currency.

Market psychology

Market psychology and trader perceptions influence the strange substitution market in a diverseness of ways:

- Flights to quality: Unsettling international events can lead to a "flying-to-quality", a type of uppercase flight whereby investors motion their assets to a perceived "safe haven". There will be a greater demand, thus a higher price, for currencies perceived as stronger over their relatively weaker counterparts. The US dollar, Swiss franc and gold have been traditional condom havens during times of political or economic uncertainty.[73]

- Long-term trends: Currency markets ofttimes motion in visible long-term trends. Although currencies do not have an annual growing flavour like physical bolt, business organisation cycles practice make themselves felt. Wheel analysis looks at longer-term price trends that may rise from economical or political trends.[74]

- "Buy the rumor, sell the fact": This market place truism tin can use to many currency situations. Information technology is the tendency for the price of a currency to reflect the impact of a particular action before information technology occurs and, when the predictable upshot comes to laissez passer, react in exactly the opposite direction. This may also be referred to every bit a market place being "oversold" or "overbought".[75] To purchase the rumor or sell the fact can also be an example of the cognitive bias known as anchoring, when investors focus too much on the relevance of outside events to currency prices.

- Economic numbers: While economic numbers can certainly reflect economical policy, some reports and numbers take on a talisman-like effect: the number itself becomes important to market psychology and may have an immediate touch on on short-term marketplace moves. "What to watch" tin can change over time. In recent years, for case, coin supply, employment, trade rest figures and inflation numbers have all taken turns in the spotlight.

- Technical trading considerations: As in other markets, the accumulated price movements in a currency pair such as EUR/USD can class apparent patterns that traders may effort to utilize. Many traders study price charts in order to identify such patterns.[76]

Financial instruments

Spot

A spot transaction is a two-day delivery transaction (except in the case of trades between the US dollar, Canadian dollar, Turkish lira, euro and Russian ruble, which settle the next business twenty-four hour period), as opposed to the futures contracts, which are usually iii months. This trade represents a "direct exchange" between two currencies, has the shortest fourth dimension frame, involves cash rather than a contract, and interest is not included in the agreed-upon transaction. Spot trading is one of the most common types of forex trading. Frequently, a forex broker will charge a small fee to the client to curlicue-over the expiring transaction into a new identical transaction for a continuation of the merchandise. This gyre-over fee is known as the "swap" fee.

Forward

I way to bargain with the foreign exchange hazard is to engage in a forward transaction. In this transaction, money does not actually change hands until some agreed upon future date. A buyer and seller hold on an commutation charge per unit for whatever date in the time to come, and the transaction occurs on that date, regardless of what the market rates are and so. The duration of the trade can be one 24-hour interval, a few days, months or years. Unremarkably the date is decided by both parties. Then the forward contract is negotiated and agreed upon past both parties.

Not-deliverable forward (NDF)

Forex banks, ECNs, and prime brokers offer NDF contracts, which are derivatives that accept no real evangelize-power. NDFs are popular for currencies with restrictions such equally the Argentinian peso. In fact, a forex hedger can only hedge such risks with NDFs, every bit currencies such as the Argentinian peso cannot be traded on open markets like major currencies.[77]

Swap

The most mutual type of forwards transaction is the foreign exchange bandy. In a bandy, 2 parties commutation currencies for a certain length of fourth dimension and concord to reverse the transaction at a later on appointment. These are not standardized contracts and are not traded through an exchange. A deposit is frequently required in order to hold the position open until the transaction is completed.

Futures

Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. The boilerplate contract length is roughly 3 months. Futures contracts are usually inclusive of any involvement amounts.

Currency futures contracts are contracts specifying a standard book of a detail currency to be exchanged on a specific settlement date. Thus the currency futures contracts are similar to forward contracts in terms of their obligation, but differ from frontward contracts in the way they are traded. In addition, Futures are daily settled removing credit risk that be in Forwards.[78] They are commonly used by MNCs to hedge their currency positions. In addition they are traded by speculators who hope to capitalize on their expectations of commutation rate movements.

Option

A foreign commutation option (normally shortened to but FX option) is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange charge per unit on a specified date. The FX options market is the deepest, largest and near liquid market for options of any kind in the earth.

Speculation

Controversy about currency speculators and their outcome on currency devaluations and national economies recurs regularly. Economists, such as Milton Friedman, have argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the of import function of providing a marketplace for hedgers and transferring gamble from those people who don't wish to behave it, to those who do.[79] Other economists, such equally Joseph Stiglitz, consider this argument to be based more than on politics and a free marketplace philosophy than on economic science.[80]

Big hedge funds and other well capitalized "position traders" are the main professional speculators. Co-ordinate to some economists, private traders could act as "noise traders" and take a more destabilizing role than larger and better informed actors.[81]

Currency speculation is considered a highly suspect activity in many countries.[ where? ] While investment in traditional financial instruments like bonds or stocks often is considered to contribute positively to economic growth past providing capital, currency speculation does not; according to this view, information technology is just gambling that often interferes with economic policy. For instance, in 1992, currency speculation forced Sweden'due south central banking company, the Riksbank, to raise interest rates for a few days to 500% per annum, and later to devalue the krona.[82] Mahathir Mohamad, one of the former Prime number Ministers of Malaysia, is one well-known proponent of this view. He blamed the devaluation of the Malaysian ringgit in 1997 on George Soros and other speculators.

Gregory Millman reports on an opposing view, comparison speculators to "vigilantes" who merely help "enforce" international agreements and anticipate the effects of basic economic "laws" in club to profit.[83] In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign commutation speculators fabricated the inevitable collapse happen sooner. A relatively quick plummet might even exist preferable to continued economical mishandling, followed past an eventual, larger, collapse. Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the arraign from themselves for having caused the unsustainable economic conditions.

Run a risk disfavor

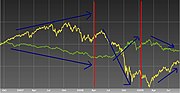

The MSCI World Index of Equities fell while the US dollar index rose

Hazard aversion is a kind of trading behavior exhibited by the foreign commutation market when a potentially adverse event happens that may affect market place conditions. This beliefs is caused when chance averse traders liquidate their positions in risky avails and shift the funds to less risky assets due to uncertainty.[84]

In the context of the foreign exchange marketplace, traders liquidate their positions in various currencies to accept up positions in safe-haven currencies, such equally the US dollar.[85] Sometimes, the choice of a safe haven currency is more of a choice based on prevailing sentiments rather than one of economic statistics. An example would be the financial crisis of 2008. The value of equities across the world fell while the Usa dollar strengthened (encounter Fig.one). This happened despite the strong focus of the crisis in the US.[86]

Carry trade

Currency carry merchandise refers to the human activity of borrowing one currency that has a low interest rate in order to buy some other with a higher interest rate. A big divergence in rates tin be highly profitable for the trader, especially if high leverage is used. Nonetheless, with all levered investments this is a double edged sword, and large exchange rate cost fluctuations can suddenly swing trades into huge losses.

See also

- Residuum of trade

- Currency codes

- Currency strength

- Foreign currency mortgage

- Strange exchange controls

- Foreign exchange derivative

- Foreign exchange hedge

- Strange-substitution reserves

- Leads and lags

- Money market place

- Nonfarm payrolls

- Tobin tax

- World currency

Notes

- ^ The total sum is 200% considering each currency trade always involves a currency pair; 1 currency is sold (e.g. United states$) and another bought (€). Therefore each merchandise is counted twice, once under the sold currency ($) and once under the bought currency (€). The percentages above are the percentage of trades involving that currency regardless of whether it is bought or sold, eastward.g. the U.S. Dollar is bought or sold in 88% of all trades, whereas the Euro is bought or sold 32% of the time.

References

- ^ Tape, Neil, Currency Overlay (Wiley Finance Series)

- ^ Global imbalances and destabilizing speculation (2007), UNCTAD Trade and development report 2007 (Chapter 1B).

- ^ a b c "Triennial Central Bank Survey of strange commutation and OTC derivatives markets in 2016".

- ^ CR Geisst – Encyclopedia of American Business History Infobase Publishing, 1 January 2009 Retrieved 14 July 2012 ISBN 1438109873

- ^ GW Bromiley – International Standard Bible Encyclopedia: A–D William B. Eerdmans Publishing Company, 13 February 1995 Retrieved 14 July 2012 ISBN 0802837816

- ^ T Crump – The Phenomenon of Money (Routledge Revivals) Taylor & Francis Usa, xiv Jan 2011 Retrieved 14 July 2012 ISBN 0415611873

- ^ J Hasebroek – Trade and Politics in Ancient Greece Biblo & Tannen Publishers, 1 March 1933 Retrieved 14 July 2012 ISBN 0819601500

- ^ S von Reden (2007 Senior Lecturer in Ancient History and Classics at the University of Bristol, United kingdom) - Money in Ptolemaic Egypt: From the Macedonian Conquest to the Finish of the Third Century BC (p.48) Cambridge University Press, 6 December 2007 ISBN 0521852641 [Retrieved 25 March 2015]

- ^ Marker Cartwright. "Trade in Aboriginal Greece". World History Encyclopedia.

- ^ RC Smith, I Walter, G DeLong – Global Banking Oxford University Press, 17 Jan 2012 Retrieved thirteen July 2012 ISBN 0195335937

- ^ (tertiary) – G Vasari – The Lives of the Artists Retrieved 13 July 2012 ISBN 019283410X

- ^ (page 130 of ) Raymond de Roover – The Rise and Pass up of the Medici Depository financial institution: 1397–94 Beard Books, 1999 Retrieved fourteen July 2012 ISBN 1893122328

- ^ RA De Roover – The Medici Bank: its organization, management, operations and decline New York Academy Press, 1948 Retrieved 14 July 2012

- ^ Cambridge dictionaries online – "nostro business relationship"

- ^ Oxford dictionaries online – "nostro account"

- ^ S Homer, Richard E Sylla A History of Interest Rates John Wiley & Sons, 29 August 2005 Retrieved 14 July 2012 ISBN 0471732834

- ^ T Southcliffe Ashton – An Economic History of England: The 18th Century, Volume three Taylor & Francis, 1955 Retrieved 13 July 2012

- ^ (page 196 of) JW Markham A Fiscal History of the U.s., Volumes ane–2 Grand.E. Sharpe, 2002 Retrieved 14 July 2012 ISBN 0765607301

- ^ (page 847) of Yard Pohl, European Association for Banking History – Handbook on the History of European Banks Edward Elgar Publishing, 1994 Retrieved fourteen July 2012

- ^ (secondary) – [1] Retrieved 13 July 2012

- ^ Southward Shamah – A Foreign Substitution Primer ["1880" is within 1.two Value Terms] John Wiley & Sons, 22 November 2011 Retrieved 27 July 2102 ISBN 1119994896

- ^ T Hong – Foreign Exchange Command in China: Starting time Edition (Asia Business Police Series Volume four) Kluwer Law International, 2004 ISBN 9041124268 Retrieved 12 January 2013

- ^ P Mathias, Southward Pollard – The Cambridge Economic History of Europe: The industrial economies : the development of economical and social policies Cambridge University Press, 1989 Retrieved 13 July 2012 ISBN 0521225043

- ^ Due south Misra, PK Yadav [two] – International Business organisation: Text And Cases PHI Learning Pvt. Ltd. 2009 Retrieved 27 July 2012 ISBN 8120336526

- ^ P. L. Cottrell – Centres and Peripheries in Banking: The Historical Development of Financial Markets Ashgate Publishing, Ltd., 2007 Retrieved thirteen July 2012 ISBN 0754661210

- ^ P. Fifty. Cottrell (p. 75)

- ^ J Wake – Kleinwort, Benson: The History of 2 Families in Banking Oxford University Press, 27 February 1997 Retrieved thirteen July 2012 ISBN 0198282990

- ^ J Atkin – The Foreign Substitution Market Of London: Development Since 1900 Psychology Press, 2005 Retrieved 13 July 2012 ISBN 041534901X

- ^ Laurence Southward. Copeland – Exchange Rates and International Finance Pearson Pedagogy, 2008 Retrieved 15 July 2012 ISBN 0273710273

- ^ Thousand Sumiya – A History of Japanese Trade and Industry Policy Oxford University Press, 2000 Retrieved xiii July 2012 ISBN 0198292511

- ^ RC Smith, I Walter, G DeLong (p.iv)

- ^ AH Meltzer – A History of the Federal Reserve, Volume 2, Book ane; Books 1951–1969 University of Chicago Press, 1 Feb 2010 Retrieved 14 July 2012 ISBN 0226520013

- ^ (page 7 "fixed commutation rates" of) DF DeRosa –Options on Foreign Exchange Retrieved 15 July 2012

- ^ K Butcher – Forex Made Elementary: A Beginner'southward Guide to Foreign Exchange Success John Wiley and Sons, 18 February 2011 Retrieved 13 July 2012 ISBN 0730375250

- ^ J Madura – International Financial Management, Cengage Learning, 12 October 2011 Retrieved 14 July 2012 ISBN 0538482966

- ^ N DraKoln – Forex for Small Speculators Enlightened Financial Press, 1 April 2004 Retrieved 13 July 2012 ISBN 0966624580

- ^ SFO Magazine, RR Wasendorf, Jr.) (INT) – Forex Trading PA Rosenstreich – The Development of FX and Emerging Markets Traders Press, thirty June 2009 Retrieved 13 July 2012 ISBN 1934354104

- ^ J Jagerson, SW Hansen – All About Forex Trading McGraw-Colina Professional, 17 June 2011 Retrieved thirteen July 2012 ISBN 007176822X

- ^ Franz Pick Selection's currency yearbook 1977 – Retrieved 15 July 2012

- ^ page seventy of Swoboda →

- ^ G Gandolfo – International Finance and Open-Economic system Macroeconomics Springer, 2002 Retrieved xv July 2012 ISBN 3540434593

- ^ Urban center of London: The History Random Firm, 31 Dec 2011 Retrieved fifteen July 2012 ISBN 1448114721

- ^ "Thursday was aborted by news of a record set on on the dollar that forced the closing of most foreign exchange markets." in The outlook: Volume 45, published by Standard and Poor's Corporation – 1972 – Retrieved fifteen July 2012 → [3]

- ^ H Giersch, K-H Paqué, H Schmieding – The Fading Phenomenon: Four Decades of Market Economic system in Deutschland Cambridge Academy Press, 10 November 1994 Retrieved 15 July 2012 ISBN 0521358698

- ^ International Center for Monetary and Banking Studies, AK Swoboda – Upper-case letter Movements and Their Command: Proceedings of the Second Conference of the International Center for Monetary and Banking Studies BRILL, 1976 Retrieved fifteen July 2012 ISBN 902860295X

- ^ ( -p. 332 of ) MR Brawley – Power, Money, And Trade: Decisions That Shape Global Economic Relations University of Toronto Printing, 2005 Retrieved fifteen July 2012 ISBN 1551116839

- ^ "... forced to close for several days in mid-1972, ... The foreign exchange markets were airtight once again on 2 occasions at the beginning of 1973,.. " in H-J Rüstow New paths to full employment: the failure of orthodox economical theory Macmillan, 1991 Retrieved 15 July 2012 → [iv]

- ^ Chen, James (2009). Essentials of Foreign Substitution Trading. ISBN0470464003 . Retrieved 15 Nov 2016.

- ^ Hicks, Alan (2000). Managing Currency Risk Using Foreign Substitution Options. ISBN1855734915 . Retrieved 15 November 2016.

- ^ Johnson, Thousand. G. (1985). Conception of Exchange Rate Policies in Aligning Programs. ISBN0939934507 . Retrieved 15 November 2016.

- ^ JA Dorn – China in the New Millennium: Marketplace Reforms and Social Development Cato Found, 1998 Retrieved fourteen July 2012 ISBN 1882577612

- ^ B Laurens, H Mehran, M Quintyn, T Nordman – Monetary and Commutation System Reforms in China: An Experiment in Gradualism International monetary fund, 26 September 1996 Retrieved 14 July 2012 ISBN 1452766126

- ^ Y-I Chung – Republic of korea in the Fast Lane: Economic Development and Upper-case letter Formation Oxford Academy Printing, xx July 2007 Retrieved xiv July 2012 ISBN 0195325451

- ^ KM Dominguez, JA Frankel – Does Foreign Exchange Intervention Work? Peterson Institute for International Economics, 1993 Retrieved 14 July 2012 ISBN 0881321044

- ^ (page 211 – [source BIS 2007]) H Van Den Berg – International Finance and Open-Economy Macroeconomics: Theory, History, and Policy Earth Scientific, 31 Baronial 2010 Retrieved xiv July 2012 ISBN 9814293512

- ^ PJ Quirk Problems in International Exchange and Payments Systems International Budgetary Fund, thirteen April 1995 Retrieved fourteen July 2012 ISBN 1557754802

- ^ "Written report on global foreign exchange market place action in 2013" (PDF). Triennial Central Depository financial institution Survey. Basel, Switzerland: Bank for International Settlements. September 2013. p. 12. Retrieved 22 Oct 2013.

- ^ "Derivatives in emerging markets", the Banking company for International Settlements, 13 Dec 2010

- ^ "The $4 trillion question: what explains FX growth since the 2007 survey? , the Bank for International Settlements, 13 December 2010

- ^ Lilley, Mark. "Euromoney FX Survey 2020 – results released".

- ^ "Triennial Central Bank Survey Foreign exchange turnover in April 2016" (PDF). Triennial Central Banking concern Survey. Basel, Switzerland: Bank for International Settlements. September 2016. Retrieved ane September 2016.

- ^ Gabriele Galati, Michael Melvin (December 2004). "Why has FX trading surged? Explaining the 2004 triennial survey" (PDF). Bank for International Settlements.

- ^ Alan Greenspan, The Roots of the Mortgage Crisis: Bubbles cannot be safely defused by monetary policy earlier the speculative fever breaks on its own. , the Wall Street Journal, 12 Dec 2007

- ^ McKay, Peter A. (26 July 2005). "Scammers Operating on Periphery Of CFTC'due south Domain Lure Little Guy With Fantastic Promises of Profits". The Wall Street Journal. Retrieved 31 October 2007.

- ^ Egan, Jack (19 June 2005). "Cheque the Currency Risk. Then Multiply by 100". The New York Times . Retrieved 30 October 2007.

- ^ The Sunday Times (London), 16 July 2006

- ^ Andy Kollmorgen. "Overseas money transfers". pick.com.au.

- ^ "Info" (PDF). world wide web.pondiuni.edu.in.

- ^ "Information" (PDF). nptel.ac.in.

- ^ "Triennial Central Bank Survey Strange substitution turnover in April 2019" (PDF). Bank for International Settlements. xvi September 2019. p. x. Retrieved 16 September 2019.

- ^ The Microstructure Approach to Exchange Rates, Richard Lyons, MIT Press (pdf chapter 1)

- ^ "To What Extent Does Productivity Drive the Dollar?" (PDF). SSRN 711362.

- ^ "Safe Haven Currency". Fiscal Glossary. Reuters. Archived from the original on 27 June 2013. Retrieved 22 April 2013.

- ^ John J. Tater, Technical Analysis of the Financial Markets (New York Institute of Finance, 1999), pp. 343–375.

- ^ "Overbought". Investopedia. Retrieved 22 April 2013.

- ^ Sam Y. Cross, All About the Foreign Exchange Market in the Usa, Federal Reserve Bank of New York (1998), chapter xi, pp. 113–115.

- ^ Gelet, Joseph (2016). Splitting Pennies. Elite Eastward Services. ISBN 9781533331090.

- ^ Arlie O. Petters; Xiaoying Dong (17 June 2016). An Introduction to Mathematical Finance with Applications: Understanding and Building Financial Intuition. Springer. pp. 345–. ISBN978-1-4939-3783-7.

- ^ Michael A. Southward. Guth, "Assisting Destabilizing Speculation," Affiliate 1 in Michael A. S. Guth, Speculative behavior and the performance of competitive markets nether dubiety, Avebury Ashgate Publishing, Aldorshot, England (1994), ISBN 1-85628-985-0.

- ^ What I Learned at the Earth Economical Crisis Joseph Stiglitz, The New Republic, 17 April 2000, reprinted at GlobalPolicy.org

- ^ Lawrence Summers and Summers VP (1989) 'When financial markets piece of work likewise well: a Cautious instance for a securities transaction tax' Journal of fiscal services

- ^ Redburn, Tom (17 September 1992). "Simply Don't Rush Out to Purchase Kronor: Sweden's 500% Gamble". The New York Times . Retrieved 18 April 2015.

- ^ Gregory J. Millman, Around the Globe on a Trillion Dollars a Day, Runted Printing, New York, 1995.

- ^ "Take chances Averse". Investopedia. Retrieved 25 February 2010.

- ^ Moon, Angela (5 February 2010). "Global markets – US stocks rebound, dollar gains on adventure aversion". Reuters. Retrieved 27 February 2010.

- ^ Stewart, Heather (9 April 2008). "IMF says US crunch is 'largest financial stupor since Neat Depression'". The Guardian. London. Retrieved 27 February 2010.

External links

- A user's guide to the Triennial Fundamental Bank Survey of strange exchange market activity, Banking company for International Settlements

- London Strange Exchange Commission with links (on right) to committees in NY, Tokyo, Canada, Australia, HK, Singapore

- Us Federal Reserve daily update of exchange rates

- Bank of Canada historical (x-year) currency converter and data download

- OECD Commutation rate statistics (monthly averages)

- National Futures Association (2010). Trading in the Retail Off-Exchange Foreign Currency Market. Chicago, Illinois.

- Forex Resources at Curlie

Source: https://en.wikipedia.org/wiki/Foreign_exchange_market

Posted by: lefflercals1967.blogspot.com

0 Response to "What Is The Forex Market"

Post a Comment