Forex Strategy That Works Every Time

Plans are essential to go along a trader disciplined and focused. Here nosotros will cover the diverse trading styles that tin be used to trade forex. Following this, we will dive deeper into specific examples of forex trading strategies commonly used by traders.

A forex trading strategy helps to provide traders with insight into when or where to purchase or sell a currency pair. However, no forex trading strategy is 'best' and not all forex trading strategies were created equal, and some may work amend in certain situations. Additionally, several trading strategies exist and each requires varying levels of technical and fundamental analysis.

How to develop a forex trading strategy

When choosing a forex trading strategy, it helps to be aware of what blazon of trader you are and what types of strategies exist. However, it is non as simple as selecting a single trading strategy, as traders can choose to utilize a single strategy or combine several.

Firstly, y'all must define your criteria for selecting a forex trading strategy. You should analyse factors that tin can help narrow down your search such as:

- How much fourth dimension you can set aside to trading forex

- What currency pairs you desire to focus on

- The size of your position

- Whether you're going long or short (larn how to short pound sterling)

Forex trading strategies

The post-obit forex trading strategies are utilised past traders to provide construction to their trading efforts. These strategies are non specifically designed for forex markets but are rather general strategies that tin can be practical to all financial markets. The strategy you decide on will correlate to the type of trader you lot are. Open an account to start practising your forex trading strategies via spread bets and CFDs.

Forex scalping strategy

Forex traders who adopt short-term trades held for simply minutes, or those who try to capture multiple price movements, would adopt scalping. Forex scalping focuses on accumulating these small but frequent profits as well as trying to limit any losses. These curt-term trades would involve toll movements of just a few pips, merely combined with high leverage, a trader can even so run the risk of significant losses.

This forex strategy is typically suited to those that can dedicate their fourth dimension to the college-volume trading periods, and tin maintain focus on these rapid trades. High volume trading periods include:

- 8.00 am to 12.00 pm GMT when both New York and London exchanges are open

- 7.00 pm to ii.00 am GMT when both Tokyo and Sydney exchanges are open

- iii.00 am to four.00 am GMT when both Tokyo and London exchanges are open

The most liquid FX currency pairs are frequently preferred equally they incorporate the tightest spreads, assuasive traders to enter and leave positions quickly. Some examples include:

- AUD/USD – 0.7pts minimum spread

- EUR/USD – 0.7pts minimum spread

- USD/JPY – 0.7pts minumum spread

Forex day trading

If you lot want to trade for short periods, but aren't comfy with the fast-paced nature of scalping, day trading is an alternative forex trading strategy. This typically involves one trade per day, which isn't carried overnight. Profit or losses are a result of whatsoever intraday cost changes in the relevant currency pair.

This type of trading would require sufficient fourth dimension to research and monitor the trade, as well as a good agreement of how the economy could impact the pair you're trading. If major economic news were to striking that day, it could affect your position. Find out more nearly forex day trading.

Forex swing trading

For traders who adopt a mid-term trading style where positions tin can be held for several days, in that location is swing trading, which aims to make a turn a profit out of changes in cost, past identifying the 'swing highs' or 'swing lows' in a tendency.

Although this strategy normally means less time fixating on the market than when day trading, it does leave you lot at take a chance of whatever disruption overnight, or gapping. Learn more about swing trading strategies.

Forex position trading

The virtually patient traders may choose the forex position trading, which is less concerned with curt-term marketplace fluctuations and instead focuses on the long term. Position traders will hold forex positions for several weeks, months, or even years. The aim of this strategy is that the currency pair's value would appreciate over a long-term period.

Forex position trading is more than suited for those who cannot dedicate hours each day to trading but take an astute understanding of market fundamentals.

Carry trade in forex

A carry trade involves borrowing from a lower interest currency pair to fund the buy of a currency pair with a college interest rate This strategy can exist either negative or positive, depending on the pair that y'all are trading. The aim is to profit from the difference in interest rates or the "interest charge per unit differential" betwixt the two foreign currencies.

Advanced forex trading strategies

The above forex trading strategies cover general variables such every bit the fourth dimension span a position is active, the time dedicated to researching markets and the time spent monitoring positions. This helps to distinguish when y'all will trade, how many positions you will open up and how yous will split up your fourth dimension between researching markets and monitoring active positions. However, the following listing includes trading strategies based on of import support and resistance levels that are specifically designed for the forex market.

1. Bounce strategy

Many forex traders believe levels that were important in the by could be of import in the time to come. This follows the logic that if a marketplace dropped to a specific level and then 'bounced' back, the market viewed this support level every bit a good place to purchase. Then, if the forex pair slips back to that level again it could, therefore, signify a potential trading opportunity.

ii. Running out of steam strategy

Similar to analysing support levels, forex traders also analyse resistance levels. The resistance level is a betoken where the market turned from its previous peak and headed back downwards. If a market place is appreciating but then suddenly falls, the overall view is likely to be that the price is getting too expensive. This forex trading strategy mirrors the bounce strategy. We are looking for the forex pair to 'run out of steam' almost that previous loftier and so go short and sell to endeavour and profit from a slide in price.

Such strategies, based on previous highs and lows on a chart, tin make run a risk management relatively straightforward for whatsoever trader. For instance, if we are looking for a bounce off a level, our stop loss can go below that previous low point. If nosotros are looking to sell short when a market starts to stammer nearly a previous loftier, and so many traders will identify a stop loss to a higher place that previous high.

The forex strategy example below shows how a high from the previous day in the AUD/USD currency pair concluded up beingness the identify where the market twice ran out of steam the following forenoon.

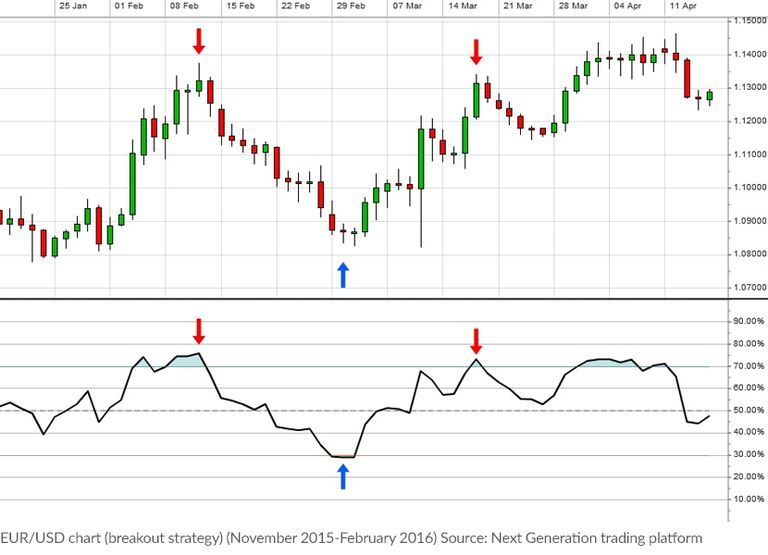

3. Breakout strategy

Resistance and support levels are dynamic and are decumbent to price breakouts in either direction. If the price exceeds important back up or resistant levels it is likely to breakout. Many traders could view this as a potentially of import change in market sentiment.

Previously when the forex pair was upward at that high, the sellers moved in and the toll fell, suggesting the market had reached an overvalued level. If that old loftier is breached, also known as breaking resistance, then something has clearly changed. Traders are now happy to keep on ownership where previously they thought the toll was likewise expensive.

This tin be an constructive forex trading strategy for catching new trends. Every journey starts with a single step. When direction in the markets changes and so the breakout trading strategy is often 1 of the early signals. The instance shown is for EUR/USD – a longer-term breakout on the daily charts.

4. Breakdown strategy

Similar in function, but in the opposite management to the breakout strategy is the breakdown strategy. This forex trading strategy is designed to jump aboard a move when a forex market slips below a previous support level. Once again, many traders could view this equally a change in sentiment towards the market place. Suddenly a level where buyers were happy to buy equally they viewed the market every bit cheap and expected it to rise – has been cleaved. This quantum of what is known as a support level can be viewed as an opportunity to short sell and try to turn a profit from further weakness in cost.

The example shows USD/JPY on an hourly chart. Information technology is an important example as it demonstrates that, in the real world, fifty-fifty the best forex trading strategies do not work all the time. There is a faux bespeak (highlighted past the circle) before the effective point (highlighted by the black arrows) that saw the market actually commencement to fall.

5. Overbought and oversold

The forex trading strategies mentioned and then far have been based on chart patterns and the use of back up and resistance levels. Our concluding strategy takes a more mathematical approach, using something chosen the Relative Force Index (RSI). This belongs to a family of trading tools known equally oscillators – so-called because they oscillate equally the markets move. When the RSI is above 70%, the marketplace is idea to be overbought. This means that it could be getting overstretched and some traders volition use this as a signal to expect the market to fall back.

Oversold is when the RSI goes beneath thirty%. Traders will be watching closely, expecting any weakness to run out of steam and the marketplace to turn back up and use this equally a buy signal. The FX example in this chart highlights some of the buy and sell signals that came from the overbought/oversold strategy on a daily EUR/USD nautical chart.

Seamlessly open and close trades, rail your progress and fix alerts

Strategy modifiers when using a forex trading strategy

When using whatsoever of the above forex trading strategies, it is wise to be aware of methods that you lot can use to adapt your forex strategy. For example, depending on your strategy, you lot may wish to use the beneath strategies alongside other forex strategies to reduce risk exposure or to provide boosted information for a forex merchandise.

Hedging forex

To protect oneself against an undesirable motility in a currency pair, traders can hold both a long and brusque position simultaneously. This offsets your exposure to the potential downside but as well limits any profit. By playing both sides of the market, you lot tin can get an thought of the management the tendency is heading, so y'all tin can potentially close your position and re-enter at a better price.

Effectively, you're buying yourself some time in order to see where the market is going, giving yourself the opportunity to amend your position. This is especially useful is y'all suspect the market to experience some short-term volatility. Therefore, hedging forex is useful for longer-term traders who predict a forex currency pair will act unfavourably but then reverse shortly after. Hedging as part of your forex strategy can assist reduce some short-term losses if y'all predict correctly.

Price action forex trading strategy

To trade forex without examining external factors like economical news or derivative indicators, you can use a forex trading strategy based on price action. This involves reading candlestick charts and using them to place potential trading opportunities, based solely on cost movements. Mostly, this strategy should exist used alongside another forex trading strategy like swing trading or day trading. This style, price action tin can exist combined with a broader strategy to help mould a trader'south next moves.

Using the price action strategy when trading forex means yous can see real-time results, rather than having to wait for external factors or news to suspension. Nonetheless, a crucial consideration for those who might use the toll action strategy is that it'south very subjective, so while one trader might see an uptrend, another might predict a potential turnaround for that particular forex pair, or that time period.

Summary

Forex trading strategies provide a ground for trading forex markets. By post-obit a full general strategy, you can help to ascertain what blazon of trader you lot are. By defining factors such as when you lot similar to trade and what indicators you like to trade on, y'all can outset to develop a forex strategy. In one case you have developed a strategy you tin can identify patterns in the markets, and examination your strategies effectiveness. However, information technology is worth noting that at that place is no 'best forex strategy' and traders often merge strategies, or make employ of strategy modifiers. This way, the forex trader is adjustable to many situations and can adapt their trading strategy to almost any forex market.

Run across the seven trading strategies every trader should know to broaden your knowledge on trading styles. Explore the forex marketplace through our award-winning Next Generation trading platform*, where you lot tin spread bet or trade CFDs on over 330 currency pairs.

FAQ

What are forex trading strategies?

Forex trading strategies involve assay of the marketplace to determine the all-time entry and exit points, as well equally position size and trade timing. Additionally, information technology can involve technical indicators, which a trader will use to try and forecast future marketplace performance. A professional trader'southward strategy often includes elements from different types of analysis and a broad diversity of trading methods, depending on their goals and objectives. Encounter our simple twenty-four hours trading strategies for means to merchandise markets if you're new to trading.

What types of analysis are used to analyse forex markets?

Forex traders can use a wide range of tools every bit function of their strategy to predict forex market place movements, but these tools fall into the categories of technical analysis and fundamental assay. Technical analysis involves evaluating assets based on previous marketplace data, in an try to forecast market trends and reversals. This usually comes in the format of nautical chart patterns, technical indicators or technical studies. Central analysis involves the analysis of macro trends such as country relationships and company earnings announcements. There are many complex factors in primal assay, but a market'due south basic fundamentals should be understood earlier trading in that market. See more on the divergence between technical and central assay.

What are the nearly common styles of forex trading strategies?

Forex trading strategies include a number of techniques such every bit time frame, forex signals used and entry/exit methods. Some of the most mutual trading strategies include forex scalping, day trading, swing trading and position trading.

Which forex pairs are the well-nigh volatile?

Exotic (or emerging) currency pairs are generally the well-nigh volatile currency pairs when trading. This is because there is less trading volume in these markets, which causes a lower level of liquidity. Volatile currency pairs offer the opportunity for quick profits, merely trading these markets likewise comes with the chance of quick losses. Larn more data about major, small and exotic forex currency pairs.

*No.1 Web-Based Platform, Platform Technology and Professional Trading, ForexBrokers.com Awards 2021; Rated Highest for Trading Ideas & Strategies, Seminars & Webinars, Merchandise Signals Package and Ease of Business relationship Awarding/Opening, based on highest user satisfaction amongst spread betters, CFD and FX traders, Investment Trends 2020 Uk Leverage Trading Report; Best Overall Satisfaction, Best Platform Features, Best Mobile/Tablet App, rated highest for Charting, Investment Trends 2019 UK Leverage Trading Study; All-time In-House Analysts, Professional Trader Awards 2019.

Forex Strategy That Works Every Time,

Source: https://www.cmcmarkets.com/en/learn-forex/forex-trading-strategies

Posted by: lefflercals1967.blogspot.com

0 Response to "Forex Strategy That Works Every Time"

Post a Comment