DuPont Analysis: Formula, Interpretation, Example, Calculator

Do you wish to know what exactly DuPont Analysis is?

DuPont Analysis is in essence on the conception of Paying back on Equity of a company that psychoanalysis on the Net profit margin, commercial enterprise leverage and asset turnover.

This analysis was corporate in the year 1920.

Now, Lashkar-e-Taiba us see in brief almost "DuPont Analysis"

What is DuPont Analysis?

The DuPont analysis is likewise known as the DuPont Model that is the financial ratio based on the income tax return on equity ratio that is put-upon to analyze the company's power to increase its return happening equity.

In a nutshell, this is the model that breaks down the return on equity ratio systematic to explain on how companies can increase their returns for investors.

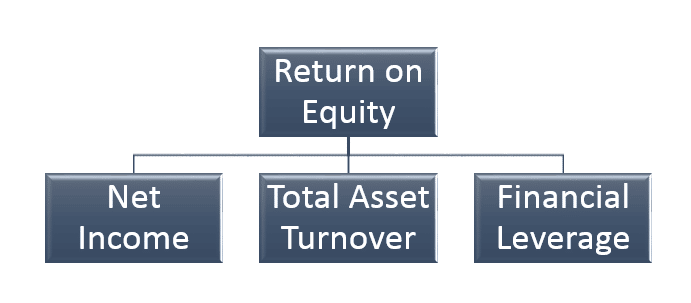

There are primary three parts for the ROE Ratio:

- Net profit Margin

- Entire Asset Turnover

- Financial Leverage

On the basis of these parts performance of any of the company measure about that the companionship can increase it's Hard roe by maintaining the high profit margin, maximising asset turnover or by leveraging the assets more in effect.

Let U.S.A see the basic formula for ROE

Let us see about the components of DuPont Analysis,

Components

- Margin of profit: – This is only the basic profitability ratio.

The pattern for this ratio is Net Profit disjunct by Add up Revenues.

This formula shows about the profit generated aft deducting all the expenses.

This is the primary factor that remains to maintain the profit margins and descend other slipway to keep growing information technology aside reducing the expenses, increasing prices etc, which volition impact the ROE.

Margin of profit:- Net Profit/ Revenues

- Total Asset Overturn: – This ratio is calculated away using the assets to jibe the efficiency of the company.

The formula for this ratio is aside dividing the revenues by average assets.

The formula for this ratio differs from across industries but information technology is useful in comparing the firms in the same industry.

It means, if the society's asset turnover increases, this act on as a positive impact on the ROE of the company.

Total Plus Turnover: Revenues/ Average Assets

- Financial Leverage: – This ratio defines about the debt usage that is in use to finance the assets.

The formula for this ratio is average Assets divided by average assets.

The companies should sustain the balance in the usage of the debt.

Therein, the debt is misused to finance the trading operations and growth of the company.

But, the usage of surplusage leverage to gain the ROE can bear out to be bad decision for the company.

Commercial enterprise Leverage: Average Assets/ Median Equity

Now, let United States of America understand about the interpretation of this psychoanalysis.

Version of DuPont Analysis

IT provides a broader read of the Return connected Fairness of the company.

It highlights the company's strengths and pinpoints the place wherever there's a telescope for improvement.

Suppose if the shareholders are ungratified with lower ROE, the company with the assistance of DuPont Analysis formula will assess whether or non the lower ROE is because of under-profit margin, bass plus turnover or poor leveraging.

Once the management of the caller has establish the light places, information technology should film steps to correct it.

The lower Hard roe mightiness not perpetually be a anteriority for the company because it may in addition happen because of normal business trading operations.

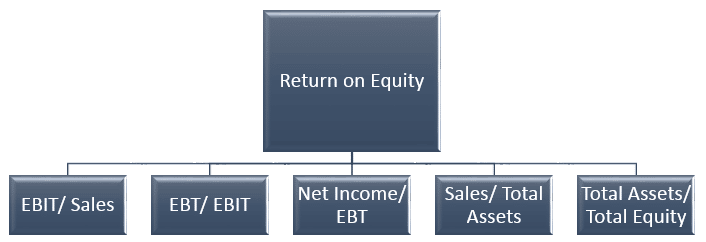

The DuPont analysis has one Sir Thomas More equation for more getting it research from the deep where the net profit margin has been further unsmooth down into the EBIT Margin, Tax Burden, and Interest Gist.

Now this is the 5 Step formula for calculating the DuPont Analysis.

There is further more naval division for computing of DuPont Depth psychology.

Limitations:

Though, the DuPont has many of the advantages simply altogether it as wel have extraordinary of the drawbacks, like:

- This analytic thinking is functional to make the comparison betwixt the companies below the synoptical industries.

- This analysis uses the convention that need to look at from the accounting data from the financial statement of the company for the analysis desig that can also be manipulated away the direction for hiding purport.

This was about the limitations of the DuPont analysis.

Lashkar-e-Toiba us get the conclusion:

Finis

This was close to on our topic "DuPont Analysis" and from this you got to know about the rul for Return on Fairness (ROE) that is important for all company to acknowledge. Thither are some conclusions Eastern Samoa this is really helpful for the investor to know about this analysis Eastern Samoa this will help them to make them further decisions for the company.

If the Net Net margin increases without any further changes in the financial leverage then information technology shows approximately the company that information technology can also capable to increase its profitability. But if the company is able to increase its ROE just because of increasing their leverage and then this becomes the risk element for the company as IT is fit to increase its assets by pickings more debt on information technology.

So, if the ROE is increasing don't take it as a good sign but again do the analysis on which factor operating room the components are contributing how practically and check that the financial leveraging should be little then only the ROE with the increment is opportune for the troupe. We hope that you care this blog on "DuPont Analysis" and you can also shares this with your mates.

Nigh Us

Trading Fire focusses main on the content for every theme near the securities market and tries to give the learners the comfort of understanding each topic with ease. So, you can also check early posted topics about the different section of the stock market. Make the days expedient for yourself and read and acquire more and piddle yourself updated. Happy Learning.

Source: https://www.tradingfuel.com/dupont-analysis/

Posted by: lefflercals1967.blogspot.com

0 Response to "DuPont Analysis: Formula, Interpretation, Example, Calculator"

Post a Comment